Sri Lanka’s Coconut Export Industry – Where are We Now?

Sri Lanka’s Position as an Exporter of Coconut Products

Sri Lanka has been exporting coconut-based products since the 19th century, when the country was still under British colonial rule. Over the years, the industry has grown and evolved in a number of ways, and today, Sri Lanka is the fourth-largest exporter of coconut products to the world. The country’s coconut export performance (in value) has grown steadily over the past decade. In 2020, the export earnings from coconut products were US dollars 664.58 million vs. US dollars 613.84 million in 2019. In short: coconut business in Sri Lanka is booming, making it arguably one of the best coconut exporters in the world.

From a market perspective, emerging economies in Latin American markets, Eastern Europe, and East Asia have recorded a higher percentage of growth, whilst more established markets in North America and Western Europe have recorded a lower percentage growth. However, it is important to note that the former is growing from a much smaller base as opposed to the latter. Looking at the export figures from 2020, the value of coconut products exported to the USA amounts to US dollars 122.33 million, whilst the second highest market in terms of value is Germany, with exports amounting to US dollars 54.95 million.

The three main categories of coconut products exported to the world market include, coconut kernel products, coconut fibre products and coconut shell products. Of these, the most popular Sri Lankan coconut kernel export products are desiccated coconut, virgin coconut oil and coconut water. Other notable products include organic coconut milk and organic coconut sugar.

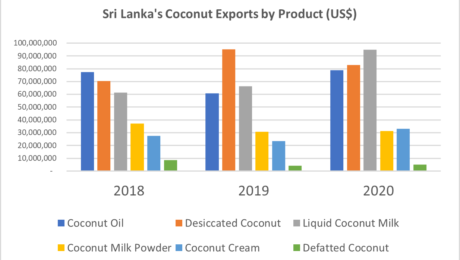

Looking at the performance of the product categories over the past three years, it is important to highlight that Sri Lanka had a very high coconut harvest in 2019, which resulted in coconut prices reducing drastically. So, the export value of a number of product categories reduced in 2019, compared to the preceding year.

Desiccated coconut exports grew massively in 2019 because of a boost in demand from the Indian market. The South Asia Free Trade Agreement enabled many Indian businesses to import desiccated coconut from Sri Lanka to fulfil the demand in the Indian market. However, towards the latter part of 2019, the Indian government placed protectionist duties on Sri Lankan desiccated coconut and the demand for the product from the Indian market reduced drastically.

The demand for liquid coconut milk has steadily increased over the past three years, resulting in 2020 recording a high export value of US dollars 94.98 million for that segment. The value of coconut oil and coconut cream exports too increased significantly from 2019 to 2020.

The Growing Demand for Coconut Products in 2020

The COVID pandemic and resulting lockdowns experienced throughout the world have had a detrimental impact on many industries, with a number of businesses shutting down completely. However, the same cannot be said of the coconut business in Sri Lanka. On the contrary, the demand for certain coconut products grew explosively, leading to the industry performing better in 2020, compared to the preceding year. Highlighted below are some of the key factors that can be attributed to this growth.

Lockdown Boredom – with people stuck in their homes for the better part of 2020, there was an increased interest in cooking and baking. People were forced to prepare their meals at home instead of going out to restaurants. They were also forced to look for activities to keep themselves occupied and entertained. Making an effort in the kitchen, learning new recipes and experimenting with ingredients became the norm for many in 2020.

Renewed Focus on Health and Wellness – as a result of being confined to their homes, people had time to stop and take a hard look at their lifestyles and make changes for the better. Building immunity and paying attention to health and wellness became a priority for many, with wholesome foods becoming a focus area. Coconut is considered a super food on a global level, so understandably the consumer buying pattern shifted in favour of coconut products.

Sri Lanka’s coconut export industry recorded a 33% dollar value growth in virgin coconut oil, 47% dollar value growth in coconut cream and 87% dollar value growth in coconut flour from 2019 to 2020 .

Furthermore, the coconut harvest in Sri Lanka fell by 15% in 2020 vs. the 2019 average, whilst the demand for the best coconut products increased on a global level. This led to a doubling of coconut prices in the first three quarters of 2020, and a tripling of coconut prices in the last quarter of 2020.

Another important fact to consider is that people are increasingly becoming far more conscious of where their food comes from. The focus on organic produce and the ‘farm to table’ concept is growing in popularity and is not just a fad any more. Sri Lanka is known to produce high-quality products such as virgin coconut oil, coconut cream and desiccated coconut, so there is an increased demand for them. By extension, organic coconut sugar, organic coconut milk, organic coconut flour, and the like, have also enjoyed greater demand.

Sri Lanka’s Coconut Export Products and Markets

USA is currently the number one buyer of coconut products exported from Sri Lanka, leading the table (in terms of dollar value) in the categories of desiccated coconut, coconut oil, coconut cream and coconut flour.

Sri Lanka’s desiccated coconut product is very popular in the world market, due to its distinguishable white hue, rich taste and texture. It is used by many leading international chocolate and biscuit manufacturers because of its unmatched quality. Liquid coconut milk, virgin coconut oil and coconut cream are also popular coconut exports from Sri Lanka, and have recorded double-digit growth from 2019 to 2020 (in dollar value). The key markets for these four products in 2020 were USA and Western Europe. See below for the emerging markets in the edible coconut products categories.

| Product Category | Emerging Market | Growth % (2019-2020)USD Value |

|---|---|---|

| Liquid Coconut Milk | Canada | 138% |

| Spain | 231% | |

| Coconut Oil | Canada | 228% |

| Spain | 252% | |

| Coconut Cream | Austria | 130% |

| Sweden | 233% | |

| Coconut Milk Powder | USA | 305% |

| Coconut Flour | Canada | 140% |

| Chile | 700% | |

| Coconut Water | Italy | 600% |

Source: Sri Lanka Export Development Board – Export Statistics

Whilst the coconut manufacturers in Sri Lanka continue to supply the global market with the aforementioned products, it also needs to consider expanding the portfolio to include products that show indications of increasing in demand in the near future.

“As more people throughout the world begin to recognise the benefit of coconut as a super food, the demand for coconut snack products, coconut-based meat alternatives and MCT oil are forecasted to rise. The time is now for Sri Lankan manufacturers to capitalise on the demand potential and develop products that will cater to the needs of a generation that is more conscious and cautious of consuming wholesome and healthy foods,” says Chandika Perera, CEO – Ceythe Japan Co. Ltd. (Saitama, Japan).

Maximising the Potential for Supply Growth

The supply of coconut is on a secular decline globally, whilst the demand appears to be growing steadily. The coconut yield per hectare is reducing in the three largest coconut product exporting nations – Philippines, Indonesia and Sri Lanka. This has been the case for the last few decades as the farming community does not see a high return in the coconut plantation business, when compared with alternatives. As a result, coconut estates have been neglected, with no replanting or proper irrigation systems being put in place, leading to low yield per hectare. However, since the demand for the best coconut products is on a rise globally, there is an opportunity for the coconut industry in Sri Lanka to fill the potential void in the market.

Coconut Yield

Sri Lanka’s Coconut Research Institute (CRI) has been actively supporting the industry for just over 90 years. The Institute’s first Corporate Plan was developed for the period 2008-2012, with the second plan coming into effect from 2013-2017.

Some of the landmark achievements of the Corporate Plans were:

- Development of high-yielding hybrids

- Soil fertility management through agroforestry systems

- Development of a process-based yield prediction model

- Identification of drought tolerant hybrids

- Integrated nutrient management

- Introduction of new coconut products

The third Strategic Plan for 2016-2020 emphasises research on rehabilitation of coconut lands, improvement of soil quality, coconut cultivation in non-traditional areas and managing uncertainty of yield and markets.

“With a growing demand for coconut products in the global market, Sri Lanka needs to focus more attention on increasing supply and competitiveness. It is inevitable that climatic conditions will have an effect on the yield, but we can take advantage of advances in technology and predictive analysis to mitigate the consequences of unpredictable weather conditions,” says Devinda de Silva, COO – Rockland Distilleries.

“Sri Lankan coconut plantations are largely neglected. The analysis of available data points to the fact that the overall crop can be increased by a minimum of 30% via better watering systems and smart fertilizing mechanisms. Well-planned irrigation systems and compost/circular economy fertilizer systems can also have a significant impact on increasing the coconut harvest. We must also dedicate more research and development into hybrid coconut plants that yield coconuts in a shorter time period and last for longer,” he adds.

Coconut Processing

According to Jason Samaranayake, CEO – Mathammana D/C Mills (Minuwangoda, Sri Lanka), “Automation is critical if we are to increase the productivity and per capita income of the workers in the coconut processing industry.”

The coconut deshelling and peeling processes, which are the most labour-intensive steps in any coconut processing facility, are gradually being semi and fully automated by coconut suppliers in Sri Lanka. This helps increase factory productivity as the number of coconuts processed per day increases significantly. The semi-automated machinery at the deshelling stage is not expensive to install or maintain. However, workers will need to become more technical and upskill to retain their jobs.

“Deshelling coconuts has gone from being a heavily labour-intensive process to being semi-automated at many facilities across the island. What this means is that a person who was earlier able to cut about 2,500 coconuts a day can now cut between 3,500-4,000 coconuts a day. The benefit is twofold – it is an efficiency improvement for the processing facility, and it also means the worker gets paid more, as his/her output increases considerably,” says Samaranayake.

Challenges Faced by Coconut Product Exporters

Trade fairs are one of the key channels available to exporters to connect with international buyers and grow the market. However, trade fairs have become increasingly expensive over the years, benefiting larger exporters over smaller ones.

“The cost for participating in a trade fair has grown drastically over the years with exporters currently having to spend a minimum of LKR 2 million per exhibition, for travel, accommodation and setting up a stall. This is a huge investment for smaller players who are just starting out in the industry, and not many can really justify the spend,” says Dulara de Alwis, CEO – Ceylon Exports & Trading Pvt Ltd (Dankotuwa, Sri Lanka). “Ceylon Exports & Trading has largely overcome this using a digital strategy to market our products and capabilities to the world. We have used Google SEO strategies such as a keyword strategy to measure global demand, developed our website information architecture based on keyword strategy, and optimised overall website content and meta titles and descriptions to serve user intent. Additionally, we have established our brand on social media platforms, registered on a number of B2B portals, and utilised global directories and the strength of Sri Lanka’s global embassy network to create client rapports via e-mail, WhatsApp and Zoom.”

The lack of effective communication skills and slow technology adoption is another challenge that many businesses face in Sri Lanka.

De Alwis says, “we are a small populous economy with 22 million people. So, in order to grow economically, we have to better integrate with the world economy through trade and other means. This becomes challenging when large numbers within our workforce still lack the ability to communicate effectively in English and other international languages. Similarly, a sizeable portion of the Sri Lankan population is not yet digitally savvy, which means that we are unable to keep up with the expectations of the global marketplace in terms of efficiency and turn-around times.”

How Can Government Support More?

The coconut export industry is supported by the Coconut Research Institute, Coconut Development Authority and Coconut Cultivation Board, all of which fall under the purview of the Ministry of Plantation Industries. Each institute works towards the overall development of the coconut industry in Sri Lanka, and undertakes responsibilities which include, generating knowledge and technology for increased yield, improving productivity and processes and providing market opportunities for coconut producers.

“Whilst we are grateful for the support given by the three government institutions dedicated to the coconut industry, we feel that there are some vital gaps that need to be addressed on a priority basis,” says de Alwis.

Trade Agreements – are critical to take advantage of our many competitive advantages. Countries provide a tax advantage for those importing in bulk (as an intermediate good) versus those importing in retail value added form (as a finished good). The former provides much less margins, and is more commoditized.

Geographical Indicators – it is now more important than ever to establish geographical indicators in the agri product space. Although Sri Lanka’s agri produce is known for its high quality globally, it is not known for saleable amounts of volume and cheap prices. Therefore, there is a clear need to drive a paradigm shift to bring more attention to Sri Lankan/Ceylon Coconut – to position it similar to Ceylon Tea and Ceylon Cinnamon.

“Sri Lanka’s Coconut Triangle has the best soil and climatic conditions for growing nutrient rich coconut. In my opinion, that by itself is a Geographical Indicator that we need to create more awareness about on a global level. It definitely needs to be in the limelight, to be communicated by our entire industry. We have a high-value product, and it needs to be recognised for what it is,” says Dulara.

Developing New Products & Sales Strategies

Since the end of colonisation, Sri Lanka has built a reputation for providing the world with high-quality agri products such as Ceylon Tea, Ceylon Cinnamon, Ceylon Cashews and Ceylon Coconut to name a few. Unfortunately, very little of the global sale value has trickled down to Sri Lanka and its hard-working farming and processing community. This needs to change through a paradigm switch, including geographical indicators (GI) and global brand building initiatives.

Many within the Sri Lankan export sector recognise that establishing geographical indicators is now more important than ever in the agri produce space. Although Sri Lanka’s agri produce is of high quality, there isn’t enough awareness globally. The government needs to push harder on creating GI’s for our export products and accelerate efforts to bring more attention to products (similar to Ceylon Tea), as well as growing regions such as ‘the Sri Lankan Coconut Triangle’, to bring provenance similar to French Wine or Swiss Cheese.

Coconut manufacturers in Sri Lanka, too, need to do their part to build brands globally. For example, Ceylon Exports & Trading has built Coco House, the first fully owned ‘tree-to-table’ Sri Lankan coconut brand, which is steadily establishing itself as a brand that curates authentic and innovative coconut products sourced directly from the famous Sri Lankan coconut triangle, offering a transparent value chain. When Sri Lankan manufacturers build locally owned brands which are recognised in the global market, it is more likely that a greater percentage of the value margin of the retail price of products will reach the farming and processing communities.

Sri Lanka’s coconut industry needs to look at food innovations to expand the export market. Meat alternative plant-based products is a category that is exploding in demand globally for sustainable and ethical reasons, and there is great potential for coconut manufacturers in Sri Lanka to meet this demand.

Sharing her thoughts about the sector, Randhula de Silva, CEO & Founder – Goodlife X says, “the multiple innovations taking place in the industry from a demand and supply perspective, as well as the vast potential for manufacturers to experiment and introduce brand-new products to the market are what keep us excited and hopeful for the future. At the end of the day, the success of the industry can have such a positive impact on livelihood development and the country’s economy overall, and that is why we persevere in the face of challenges.”