The Coconut Export Industry in Sri Lanka - Update 2023

An Overview of Sri Lanka’s Coconut Cultivation and Export Industry

Sri Lanka, renowned for its lush coconut plantations, remains a major player in the global coconut industry. As the fourth-largest exporter of coconut products, the country’s coconut sector is integral to its economy, providing employment and significantly contributing to export revenues. [1] The industry produces a wide range of products, including coconut oil, desiccated coconut, coconut milk, and value-added items such as coconut water and activated carbon.

Over the past decade, Sri Lanka’s coconut industry has undergone significant transformation. By embracing global quality standards, the industry has enhanced product quality and market competitiveness. Investments in technology and sustainable practices have bolstered production efficiency and environmental stewardship. The industry has also diversified its product portfolio, introducing innovative coconut-based products while maintaining traditional offerings. These advancements have led to a notable increase in production volume, supported by improved agricultural practices and better plantation management.

Despite these significant advancements and the industry’s overall growth trajectory, recent years have posed unprecedented challenges. To understand the current state of Sri Lanka’s coconut sector, the analysis below shows the performance trends and factors impacting the industry in 2023.

Sri Lanka’s Coconut Export Performance in 2023

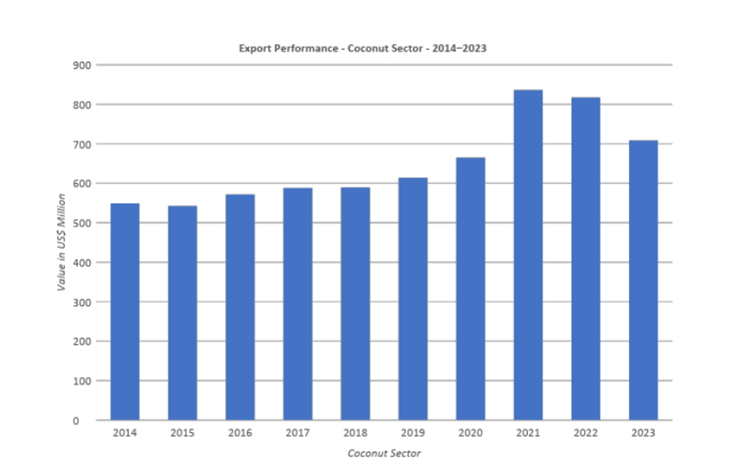

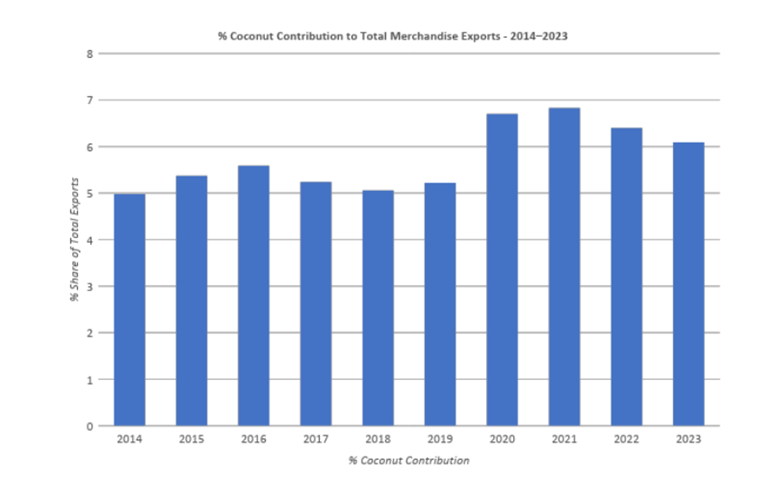

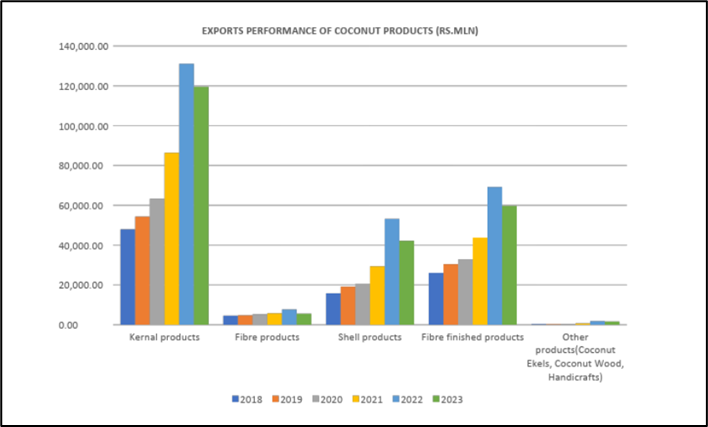

According to data from the Sri Lanka Export Development Board, the country’s coconut export industry has experienced consistent growth over recent years. However, 2022 marked the first instance of negative growth in nearly a decade, and this decline has continued into 2023. The year 2023 presented unique challenges that impacted performance.

Source: Sri Lanka Export Development Board (EDB)

Source: Sri Lanka Export Development Board (EDB)

Several factors have contributed to the decline in coconut export performance in 2023:

Source: Sri Lanka Export Development Board (EDB)

● Rising Interest Rates and High Inflation in Importing Countries – Economic pressures in key markets, such as rising interest rates and high inflation, have significantly affected purchasing power and demand for coconut products. Consumers in these markets are spending less on non-essential goods, including imported food items, leading to reduced orders and lower export volumes from Sri Lanka. Food companies have been particularly impacted by the lingering effects of pandemic-induced inflation, with retailers pushing for aggressive discounts.[2] Consumers are notably trading down to cheaper supermarket private label brands across various food categories.

● Debt Crisis in Emerging Markets – Emerging markets such as Egypt and Pakistan have been grappling with severe economic turmoil, including debt crises. These financial challenges have diminished their capacity to import goods, including coconut products, negatively impacting Sri Lanka’s export figures. The Sri Lankan Desiccated Coconut Association claimed that Egypt was one of the premium buyers of higher-grade desiccated coconut, and their economic crisis has been deeply felt by the trade.[3]

● Extended War in Europe and the Middle East – Ongoing conflicts in Europe and the Middle East have disrupted trade routes and economic stability in these regions. The instability has led to logistical challenges, increased shipping costs, and general uncertainty in trade, contributing to the decline in coconut exports from Sri Lanka to these areas. “The cost of a container to Europe has increased from USD 500 to USD 3,000 since the beginning of the Red Sea disruptions,” stated Dulara de Alwis, CEO of Ceylon Exports & Trading Pvt Ltd, a coconut products manufacturer and exporter from Sri Lanka. He noted that the company has now rerouted nearly 50% of its volumes from the Suez Canal to the Cape of Good Hope.

● Debt and High-Interest Rate Environment in Sri Lanka – Sri Lanka itself has faced significant economic challenges, including a debt crisis followed by a high-interest rate environment. Interest rates, which were above 20% for half of the year, have increased the cost of borrowing for businesses. “Exporters who are paid on an industry norm BL + 60-90 day basis have had to forgo several percentage points in margin because of working capital interest costs,” stated Hasitha de Alwis, Director of Ranfer Teas. Central Bank data in 2023 also shows that the Manufacturing PMI (Purchasing Manager’s Index) has been contracting for 10 of the 12 months of 2023.

● Exchange Rate Fluctuations – The strengthening of the Sri Lankan rupee after many years of depreciation has created additional challenges for exporters. The exchange rate has strengthened from USD/LKR 365 at the start of the year to USD/LKR 325 by year-end. A stronger currency makes Sri Lankan products more expensive on the global market, complicating pricing strategies and reducing competitiveness. “The short-term volatility in exchange rates is a nightmare for exporters since we have to commit to a price before the product is exported,” states Dulara, CEO of Ceylon Exports & Trading. “Once the costs are incurred, the product is exported and the exchange rate strengthens by an additional 10%, that leads to a direct impact on the company’s profitability.”

● Lower Coconut Harvest – After experiencing two bumper harvests in 2021 and 2022, the coconut yield in 2023 was 10% lower. The Coconut Research Institute of Sri Lanka reports that the harvest fell below 3 billion coconuts in 2023 after two consecutive years of topping 3.35 billion coconuts. This reduced harvest has limited the supply of coconuts available for export, directly impacting the volume of products that Sri Lanka could send to international markets.

Snapshot of Global Coconut Producers

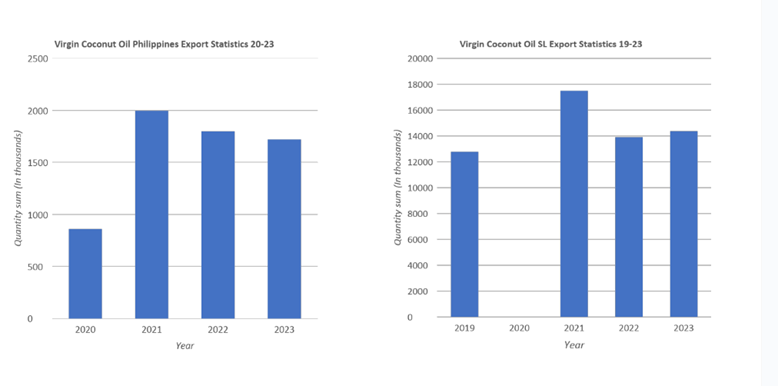

Sri Lanka remains one of the top five coconut-producing countries globally, competing with leading producers such as the Philippines, Indonesia, and India. The country’s strategic position in the global market is reinforced by its quality products and diverse range. Despite facing challenges, Sri Lanka’s coconut industry holds a competitive edge in terms of product quality and innovation. The downturn in 2023 affected not only Sri Lanka but also other major producers like the Philippines, as illustrated by the virgin coconut oil export data chart.

Source: Customs Data

Sri Lanka’s Coconut Export Portfolio

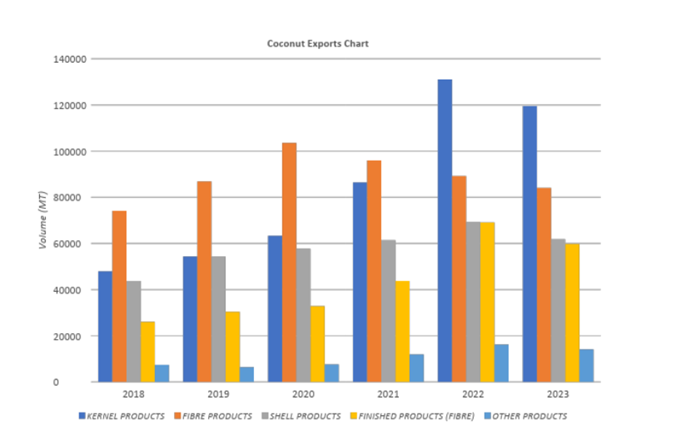

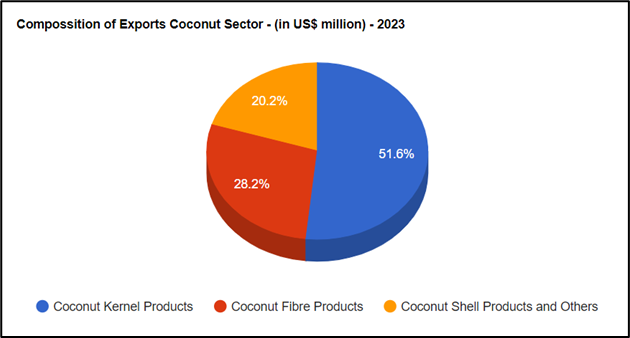

Sri Lanka’s coconut exports are categorised into kernel products, finished fibre products, and shell products. In 2023, kernel products accounted for 51.6% of the total export value, generating USD 365.94 million. Fibre products contributed 28.2% of the total export value, amounting to USD 199.8 million. Meanwhile, shell products comprised 20.2% of the total export value, contributing USD 142.95 million.

Source: Sri Lanka Export Development Board (EDB)

In recent years, market dominance has been observed in specific product categories, according to Sri Lankan customs data:

● Virgin Coconut Oil, Desiccated Coconut, and Coconut Milk: 10–15 companies dominate 75% of the export market share.

● Activated Carbon: Three companies, Haycarb PLC, Jacobi Carbons, and Manisha Carbon, control the majority of the market share.

● Moulded Coir Products: 20 players possess 75% of the market share in horticultural products.

Major Coconut Export Markets

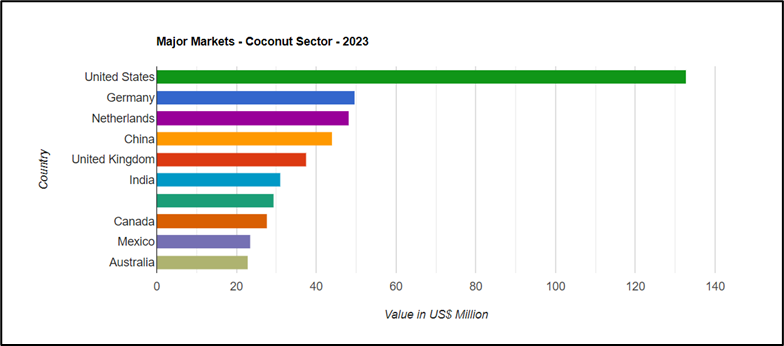

The USA remains Sri Lanka’s largest coconut export market in 2023, with an export value of USD 132.68 million. Germany is the second-largest market, with an export value of USD 49.67 million, followed by the Netherlands in third place, with an export value of USD 48.1 million.

Source: Sri Lanka Export Development Board (EDB)

Similar to 2022, the key emerging markets for Sri Lanka’s coconut exports in 2023 are India and China. India’s demand has surged due to its large population and rising disposable incomes, driving higher spending on health and wellness products. Similarly, China’s growing middle class shows increasing interest in natural and organic products, including those made from coconut.

According to 2023 export performance data, the USA is the leading global market for Sri Lankan activated carbon exports, with China and Germany following closely behind. In contrast, the majority of coco peat, fibre pith, and moulded product exports have been directed towards Mexico, Japan, and China. Germany, the UK, and the USA have emerged as the primary markets for liquid coconut milk, while desiccated coconut, has primarily been exported to Pakistan, India, and the United Arab Emirates.

Source: Sri Lanka Export Development Board (EDB)

Coconut Harvest Trends of Sri Lanka

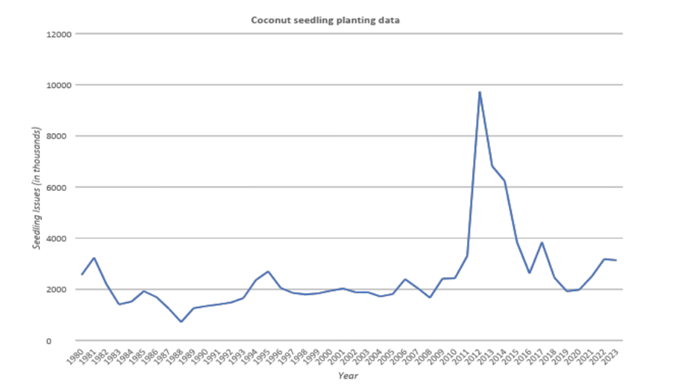

2023 saw a slight drop in coconut production compared to 2022, despite a rise in the number of seedlings planted in the previous year. The overall trend of replanting has significantly decreased compared to a decade ago, which may lead to a notable decrease in future coconut production. While 2022 saw one of the highest harvests in recent history, continuing the momentum from 2021, the decline in replanting efforts is becoming more apparent.

Source: Coconut Cultivation Board (CCB)

Moreover, the government owns over 75% of the country’s land, including coconut plantations, leading to suboptimal yields compared to privately-owned estates. “Yields in the state-owned estates in the coconut triangle are less than half of those in privately-owned plantations,” says Altaf Jeevunjee, a coconut plantation owner.

Mr. Deepal Priyanjith, Assistant General Manager, Planning Division, Coconut Cultivation Board, highlights several issues that the industry currently faces. “The lack of fertiliser applications, inadequate irrigation facilities, poor land management, high labour, energy, and input costs, price fluctuations, aged plantations, and wild animal attacks are some of the more significant challenges that Sri Lanka’s coconut industry is facing,” says Priyanjith. He highlights that financial assistance for irrigation facilities, promotion of mass and digital media facilities, and subsidised inputs (seedlings) are some of the critical solutions that can be implemented to assist in coconut production.

New Product Development

Industry experts note that Sri Lanka’s coconut sector has preserved its global market leadership by responding to shifting market demands and investing in innovative technologies. Listed below are a few ways by which this has been achieved:

● Plant-Based Trend – The global shift towards plant-based diets for sustainability and ethical reasons has benefited coconut milk derivatives. According to Euromonitor, Germany is expected to see a 9% annual growth in plant-based milks over the next several years.

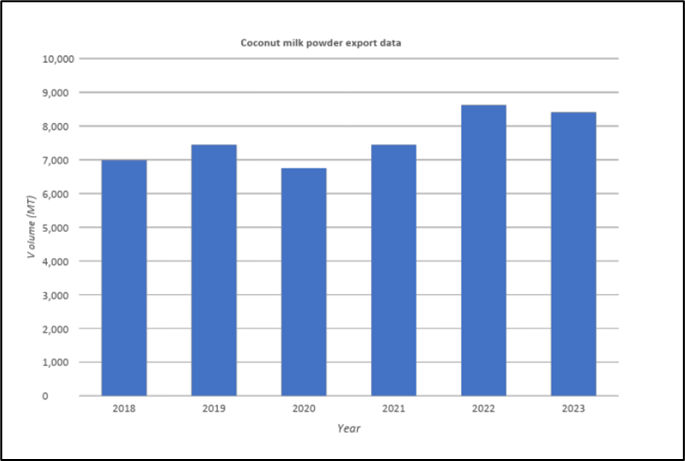

● Coconut Milk Powder – Coconut milk powder is gaining popularity due to its convenience, longer shelf life, and easier storage. Export data from 2018 to 2024 shows a steady increase in demand.

Source: : Coconut Development Authority (CDA)

● Coconut Water Concentrate – Some of the newer global beverages are opting to use coconut water concentrate as an ingredient in their formulation. An example of this is the beverage Prime, backed by YouTube influencer Logan Paul, which has surpassed the USD 1 billion sales mark (Yahoo Finance). “Currently, Sri Lanka does not manufacture coconut water concentrate due to concerns about supply availability among coconut water processors and the high investment requirement,” stated a source from a leading coconut water export company who wished to remain anonymous. “But the taste and other sensory profiles of the product are superior, and the future manufacturing potential in the country should be looked into.” This highlights a significant opportunity for Sri Lanka’s coconut industry to expand into the production of coconut water concentrate, leveraging its superior taste and sensory qualities to tap into the growing global market.

Ceylon Exports & Trading Pvt Ltd. is engaged in research and development to create new products that align with global market trends. The company launched Nootz, the world’s first coconut smoothie, made from a completely organic coconut milk base blended with natural tropical fruits and containing no preservatives. “Nootz is the world’s first plant-based alternative from a coconut milk base, and we have been overwhelmed by the response the product has received,” says Dulara de Alwis, Chief Executive Officer of Ceylon Exports & Trading (Pvt) Ltd. Nootz is emerging in the coconut smoothie space, with competitors like Harmless Harvest growing 24% year-over-year in the USA, surpassing the USD 20 million sales mark, according to SPINS.

Strategies for Future Growth

Several strategies are in place to ensure the growth of the coconut export industry, including:

● New Coconut Triangle – The establishment of a new coconut triangle, spearheaded by the Sri Lankan Government, in the Jaffna, Mannar, and Mullaitivu Districts is expected to boost production and export capabilities.[4]Land fragmentation for housing purposes in the original Sri Lankan coconut triangle, consisting of Puttalam, Kurunegala, and Negombo, has led to a reduction in coconut acreage over the last several decades.[5] This has expedited the case for a new coconut triangle in an area with lower land value and lower economic output.

● Encouraging Smarter Local Consumption – Currently, only 30% of the coconut harvest is used for export purposes, while 70% is consumed locally. Since coconuts consumed at home are not as mechanised as the processing industry, efforts are underway to optimise local usage and reduce wastage.[6] Private sector players such as Silver Mills are encouraging local consumers to opt for retail options for better convenience and to reduce efficiency wastages, according to Jason Samaranayake from Mathammana DC Mills, one of Sri Lanka’s largest desiccated coconut manufacturers.

● Accessing Technical Knowhow and Concessionary Capital – International financial organisations such as the Asian Development Bank have been supporting agri-processing companies, particularly SMEs, through various concessionary schemes to expand capacity and obtain access to working capital at concessionary interest rates. Shashikala Seneviratne, in the credit department of Nations Trust Bank, a leading local bank, claims that there are new concessionary schemes offered by the ADB following the crisis for SME agri-processing exporters to bridge financing gaps.

Moreover, Organisations such as PUM, the Dutch government-supported non-profit, continue to share their database of PhD experts in various fields with local companies that want to innovate, commercialise, and market products. Sheran de Silva, Director at MAS Tropical, a leading organic and fair trade spice manufacturer and exporter, shares that PUM expertise has been significant for the company to innovate and commercialise new products for the EU market. It is important that both the Sri Lankan government and the private sector work towards obtaining available technical knowhow and concessionary financing schemes.

Taking the Industry Forward

Sri Lanka’s coconut industry has demonstrated resilience and adaptability despite facing significant challenges in 2023. The commitment to quality, product diversification, and new market developments have positioned the industry for future growth. The outlook for 2024 is promising, with a 24% USD value growth in the first four months of 2024 compared to the previous year. However, the low coconut crop remains a constraint. Continued focus on sustainable practices, new product development, and strategic market expansion will be crucial for sustained growth.

[1] https://www.srilankabusiness.com/coconut/about/industry-capability.html#:~:text=Sri%20Lanka%20is%20the%20fourth,products%20to%20the%20global%20market

[2] https://www.wsj.com/business/retail/food-companies-are-still-paying-the-price-for-years-of-inflation-c0096b14?mod=hp_lista_pos3

[3] https://www.bloomberg.com/news/articles/2024-03-27/egypt-pakistan-await-verdict-on-emerging-market-demotion-threat

[4] https://www.presidentsoffice.gov.lk/index.php/2023/08/02/second-coconut-triangle-to-be-launched-in-the-northern-province-parallel-to-world-coconut-day/

[5] https://fos.cmb.ac.lk/blog/land-fragmentation-an-environmental-crisis/

[6] https://www.parliament.lk/uploads/documents/paperspresented/annual-report-coconut-development-authority-2018.pdf