The Coconut Export Industry in Sri Lanka – 2024 Update

An Overview of Sri Lanka’s Coconut Cultivation and Export Industry

With a cultural legacy as rich as its tropical soil, Sri Lanka’s coconut industry continues to play a vital role in the national economy. The coconut tree, known locally as the “Tree of Life,” is deeply embedded in the country’s cuisine, religious rituals, and rural livelihoods. Approximately one million Sri Lankans’ rely on the coconut sector, and over 455,000 hectares of land are dedicated to coconut farming, reinforcing its socioeconomic significance.

As of 2024, Sri Lanka remained the fourth-largest exporter of coconut-based products globally. Its export portfolio includes virgin coconut oil, desiccated coconut, coconut milk, coconut water, activated carbon, coir fibre, and moulded horticultural products.

In 2024, a key milestone was the formation of the Ceylon Chamber of Coconut Industries, uniting nearly all coconut-related associations under one apex body. Backed by the European Union-funded BESPA-FOOD project and facilitated by UNIDO, the Chamber has set ambitious goals: to increase annual coconut production to 4.5 billion nuts and raise export revenue to USD 1.5 billion within five years. As a first step, it plans to digitally map every coconut tree in the country by age, location, and type. The chamber includes representatives from the Coconut Growers Association, Exporters Association of Coconut Based Substrates, Sri Lanka Virgin Coconut Oil Manufacturers Association, Coconut Product Manufacturers and Exporters Association, Ceylon Desiccated Coconut Manufacturers Association, Ceylon Coir Fibre Manufacturers Association, Coconut Milk Manufacturers Association, and the All Ceylon Coconut Oil Manufacturers Association.

Long-Term Harvest Trends: A Two-Decade Snapshot

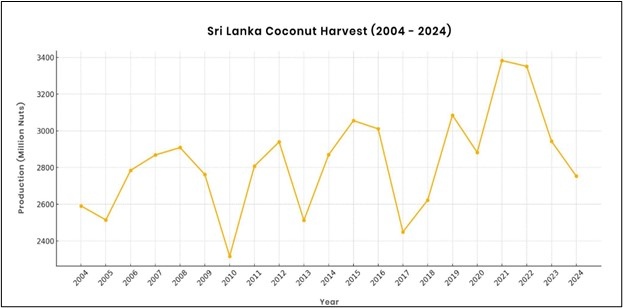

Despite advancements in processing and export diversification, Sri Lanka’s coconut harvest has shown limited long-term growth over the past two decades. In 2004, the country produced 2.59 billion nuts, while in 2024, the figure stood at 2.75 billion nuts, reflecting an increase of just 6.3 percent over 20 years.

Source: Coconut Research Institute (CRI)

During this period, harvest volumes have fluctuated between approximately 2.3 and 3.4 billion nuts, with peak years such as 2021 (3.38 billion) and 2022 (3.35 billion) driven by favourable weather conditions and improved cultivation practices. However, these gains have not been sustained. The average production from 2020 to 2024 was 3.06 billion nuts, while the average for the 2004 to 2008 period was 2.74 billion, indicating only modest progress.

According to Jason Samaranayake, Managing Director of Mathammana DC Mills, the El Niño weather pattern in 2023–2024 triggered both drought and flooding, disrupting the coconut supply chain with delayed effects across a 6 to 12-month window. The CRI Director further attributed reduced yields to continued neglect of coconut farms caused by fertiliser shortages and elevated fuel costs during the 2022–2023 economic crisis.

This minimal growth highlights structural challenges such as ageing plantations, limited replanting, climate variability, and land ownership constraints. Without meaningful investment in replanting, irrigation, and land productivity, the country may face long-term supply limitations that could impact its export ambitions.

A recent comparison by the Coconut Growers Association highlighted that Sri Lanka’s coconut yield per hectare is less than half that of Andhra Pradesh in India, despite similar climatic conditions. This stark productivity gap underscores the urgent need for replanting programs, scientific management, and modernisation of large-scale estates to close the yield deficit and remain competitive regionally.

Coconut Harvest Trends in 2024

In 2024, Sri Lanka’s coconut harvest dropped to 2.75 billion nuts, marking the lowest output in five years. This steep decline followed two consecutive high-performing years and occurred despite global market momentum and increased export demand.

Source: Coconut Cultivation Board (CCB)

Several interlinked issues contributed to the downturn:

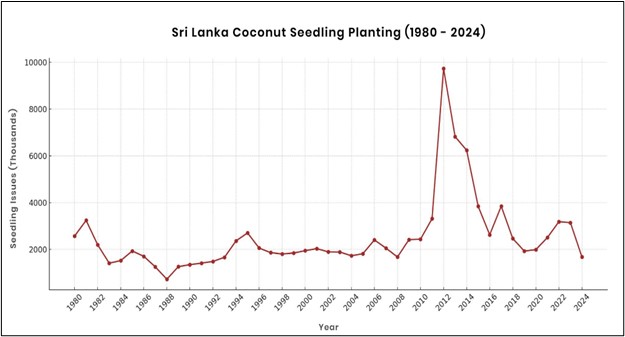

●Replanting rates have significantly dropped over the past decade, with only 1.67 million seedlings planted in 2024. Without consistent replanting, many plantations are ageing and less productive.

●Approximately 75 percent of coconut-growing land is state-owned, and these public estates produce less than half the yield of private plantations. As highlighted by plantation owner Altaf Jeevunjee, this land ownership imbalance remains a major constraint to yield optimisation.

●Climate disruptions from the El Niño event further exacerbated the situation, with erratic rainfall patterns and prolonged dry spells hurting yield potential.

These challenges underscore the urgent need for institutional reform, productivity-focused policies, and investments in replanting and land efficiency to secure long-term sustainability for the industry.

Sri Lanka’s Coconut Export Performance in 2024

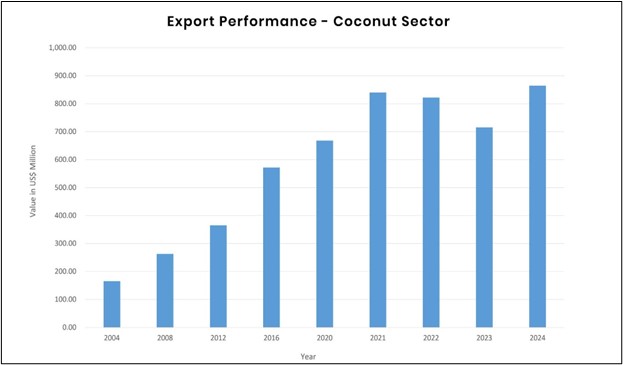

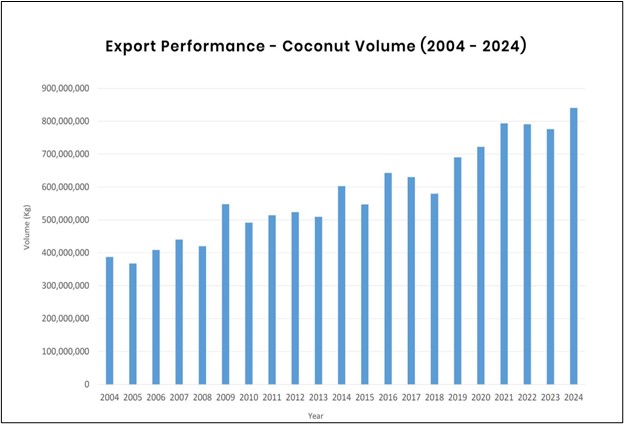

Following a contraction in 2023, the coconut export industry switched back into growth in 2024, expanding by 22 percent in USD export value. This rebound occurred despite one of the worst harvests in the last five years and the total production fell to 2.754 billion nuts, significantly lower than the 3 billion-plus volumes seen in most of the preceding years.

Source: Sri Lankan Export Development Board (EDB)

Source: Sri Lankan Export Development Board (EDB)

Source: Sri Lankan Export Development Board (EDB)

The recovery in 2024 also came against the backdrop of the highest coconut prices recorded in Sri Lanka’s history. Dehusked coconut prices surged from LKR 110 to LKR 330 per kilogram, according to Dulara de Alwis, CEO of Ceylon Exports & Trading. The resulting price pressure became politically sensitive. With 70 percent of coconuts consumed domestically, the government responded by offering subsidised coconuts through Sathosa outlets. As reported by News First, Lanka Sathosa began distributing 200,000 coconuts daily at reduced prices to ease the burden on household consumers. The Sunday Times highlighted growers’ concerns: low yields, high input costs, and a lack of consistency in both climate and policy threaten long-term viability.

The supply-side strain extended well beyond Sri Lanka. Franklin Baker, a coconut industry giant in the Philippines with a heritage spanning over a century, was forced to shut down operations and restructure its debts. Its downfall signalled how deeply the 2024 price surge disrupted even the most experienced players in the global coconut trade.

Snapshot of Global Coconut Producers

Sri Lanka remains one of the top five coconut-producing countries in the world. According to 2024 data from the World Population Review, Sri Lanka ranked 5th globally in coconut production, ahead of Vietnam and Papua New Guinea. This reflects not only the country’s consistent output, but also its strategic importance in global coconut trade.

The top three producers continue to be Indonesia, the Philippines, and India. Together, these countries account for more than 70 percent of the world’s coconut production, creating intense competition in the export market.

Despite producing a smaller volume than the top three, Sri Lanka stands out in the global market due to its strength in high-value export products such as coconut milk, activated carbon, and coir fibre. Its continued relevance stems from a focus on quality, innovation, and the diversification of value-added coconut products.

Sri Lanka’s Coconut Export Portfolio

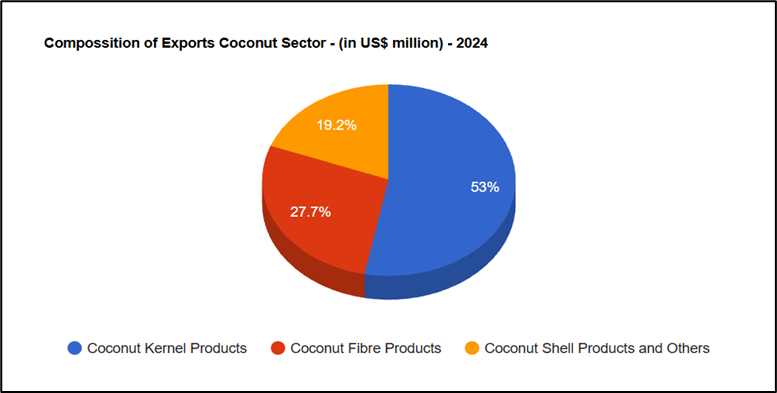

According to the Sri Lanka Export Development Board (EDB), coconut-based export earnings in 2024 exceeded USD 864.3 million, reflecting a well-diversified product mix. Kernel products, which include desiccated coconut, coconut milk, and virgin coconut oil, accounted for the largest share, generating USD 458.25 million or 53 percent of total export revenue. Fibre products, such as coir pith and moulded fibre items, contributed USD 239.83 million, representing 27.7 percent of exports. Meanwhile, shell products, including activated carbon and related derivatives, made up 19.2 percent, amounting to USD 166.22 million.

This balance across product categories demonstrates the sector’s ability to cater to diverse international market demands while building resilience through value addition. Export growth was further bolstered by the Sri Lanka Export Development Board’s expanded SME support. According to Assistant Director Gayan Weerasinghe, 50 percent more SMEs received trade fair subsidies in 2024 than in 2023.

Source: Sri Lankan Export Development Board (EDB)

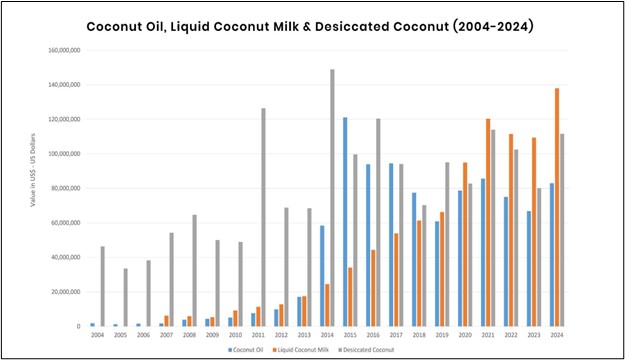

Over the last ten years, Sri Lanka’s top-performing edible coconut products, liquid coconut milk, desiccated coconut, and virgin coconut oil, have shown consistent export growth. As illustrated in the chart below, liquid coconut milk has emerged as the strongest driver of revenue growth, outpacing the other two categories in value.

Source: Sri Lankan Export Development Board (EDB)

This upward trend in coconut milk exports reflects global consumer shifts toward plant-based, dairy-free, and health-focused alternatives. Its versatility in culinary applications, from curries and smoothies to desserts and coffee creamers, has made it a popular choice among vegan and health-conscious consumers. Desiccated coconut and virgin coconut oil have also remained strong contributors, supported by demand from confectionery, bakery, and wellness-focused product segments.

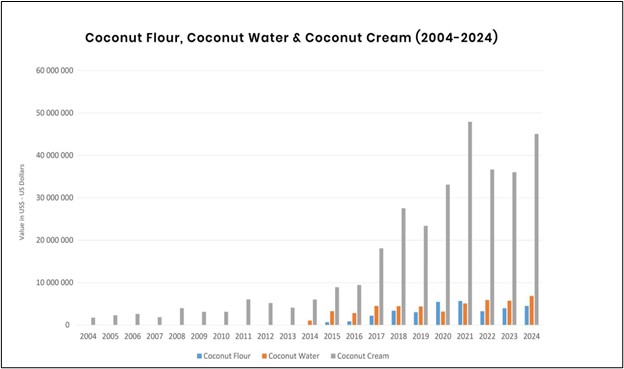

Source: Sri Lankan Export Development Board (EDB)

New edible coconut products such as coconut flour, coconut water, and coconut cream, which were previously considered byproducts or underutilised outputs of kernel processing, have now become commercially valuable exports. As shown in the chart above, coconut cream has emerged as a significant contributor, crossing USD 40 million in export value by 2024. Coconut water and flour have also demonstrated a consistent upward trend. The overall growth across these kernel-based products highlights Sri Lanka’s rising prominence in high-value food-grade coconut exports.

This shift highlights the industry’s ongoing efforts to enhance value addition. Especially in a context where overall coconut production volumes have remained largely unchanged, Sri Lanka has been able to maximise export potential by making better use of the coconut as a whole. These innovations not only reduce waste but also align with rising global demand for health-focused, plant-based products.

Major Coconut Export Markets

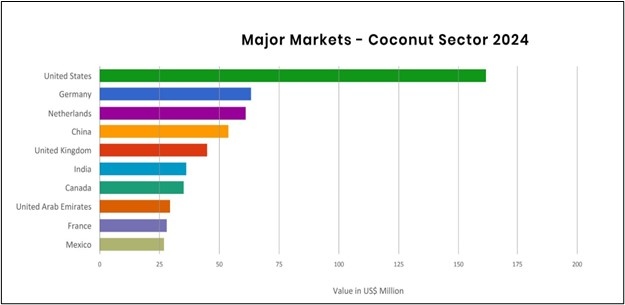

In 2024, the United States continued to be Sri Lanka’s top destination for coconut exports, with shipments valued at USD 132.68 million. Germany secured the second spot, importing coconut products worth USD 49.67 million, while the Netherlands ranked third with exports totalling USD 48.1 million.

Source: Sri Lankan Export Development Board (EDB)

Emerging markets such as India and China have shown significant growth in demand. India’s expanding population and increasing disposable incomes are fuelling greater consumption of health-focused and natural coconut products. Similarly, China’s growing middle class is driving interest in organic and wellness-oriented coconut offerings.

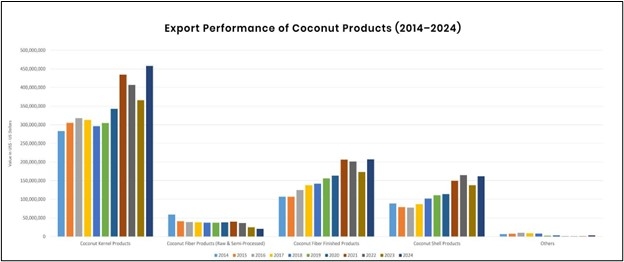

Sri Lanka’s coconut product exports in 2024 showed strong performance across all major categories. Coconut kernel products led the way, exceeding USD 450 million in value. This milestone was driven by growing global demand for coconut milk, virgin coconut oil, and desiccated coconut. Finished fibre products also continued to grow steadily, supported by increased usage in the horticulture and construction sectors. Coconut shell products, especially activated carbon, maintained their momentum due to rising demand for natural filtration materials. While raw and semi-processed fibre exports remained relatively flat, the overall trend points toward a clear shift in Sri Lanka’s coconut sector from raw materials to value-added exports.

Source: Sri Lankan Export Development Board (EDB)

Strategies for Future Growth

To strengthen long-term resilience and competitiveness, Sri Lanka’s coconut industry introduced several strategic measures in 2024 to address persistent productivity constraints and structural challenges. According to the Director of the Coconut Research Institute (CRI), a number of these interventions were critical to navigating the year’s supply-side pressures:

● Fertiliser Availability and Pricing

Fertiliser access improved following negotiations with importers and dealers, although prices remained high. Through the World Food Programme, Sri Lanka received 55,000 metric tons of Muriate of Potash (MOP), with 27,500 metric tons allocated specifically to coconut farming. The Coconut Cultivation Board used this supply to produce Adult Palm Mixture (APM) fertiliser, which was distributed to growers at subsidised prices. The CRI Director emphasised that while availability improved, cost remained a major concern for farmers, especially smaller landholders.

Access to Equipment and Inputs

Farmers continue to face elevated costs for field equipment, irrigation tools, pest-control chemicals, and packaging materials. As noted by the CRI Director, formal requests have been submitted to relevant ministries to reduce import taxes on essential items and to promote domestic manufacturing of tools such as plastic buckets and polybag covers.

Mechanisation and Financial Access

According to the CRI Director, the use of field machinery has declined significantly due to rising fuel prices, further straining farm productivity. While low-interest financing under the Kapruka Aryojana loan scheme has helped some farmers develop their plantations, these measures are not sufficient. The CRI Director stressed the need for broader, large-scale government involvement to support field-level mechanisation and infrastructure development.

Labour Costs and Market Volatility

The CRI also reported that high labour costs and unpredictable farm gate prices continue to limit the profitability of coconut cultivation, particularly for smallholder farmers. These factors have made long-term financial planning difficult and have discouraged investment in land development and maintenance.

Extension Services and Knowledge Sharing

Fuel-related budget constraints have reduced the frequency of field-level extension services. In response, the CRI and relevant authorities have increasingly turned to digital platforms, using social media and mass media to disseminate technical knowledge and practical guidance to growers.

Processing-Side Innovation

The industrial segment of the coconut industry is also evolving. Semi-automation has begun replacing traditional manual labour in several areas. For example, dehusking machines adopted by Mathammana DC Mills now process up to 700 coconuts per hour, compared to around 250 by skilled manual workers. These innovations are improving processing efficiency and demonstrate how technology is reshaping productivity across the coconut value chain.

Taking the Industry Forward

Despite facing adverse weather, rising costs, and limited yield growth, Sri Lanka’s coconut export industry proved remarkably resilient in 2024. Strong global demand, renewed policy support, and private-sector innovation have helped the sector rebound.

Looking ahead, the industry’s performance in January to June 2025 indicates further upside. According to EconomyNext, coconut-based exports were a key driver of Sri Lanka’s 6.85 percent increase in total national exports. If this trajectory continues, coconut exports are on track to cross USD 1 billion in 2025.

With unified stakeholder action and targeted investment, Sri Lanka can reclaim its place as a world leader in high-value coconut innovation.

[6] https://www.sundaytimes.lk/250727/business-times/coconut-growers-in-a-dilemma-606398.html

[7] https://business.inquirer.net/508468/franklin-baker-seeks-loan-restructuring

[8] https://www.chelmerfoods.com/news/desiccated-coconut-market-news-27-11-24

[9] https://worldpopulationreview.com/country-rankings/coconut-production-by-country